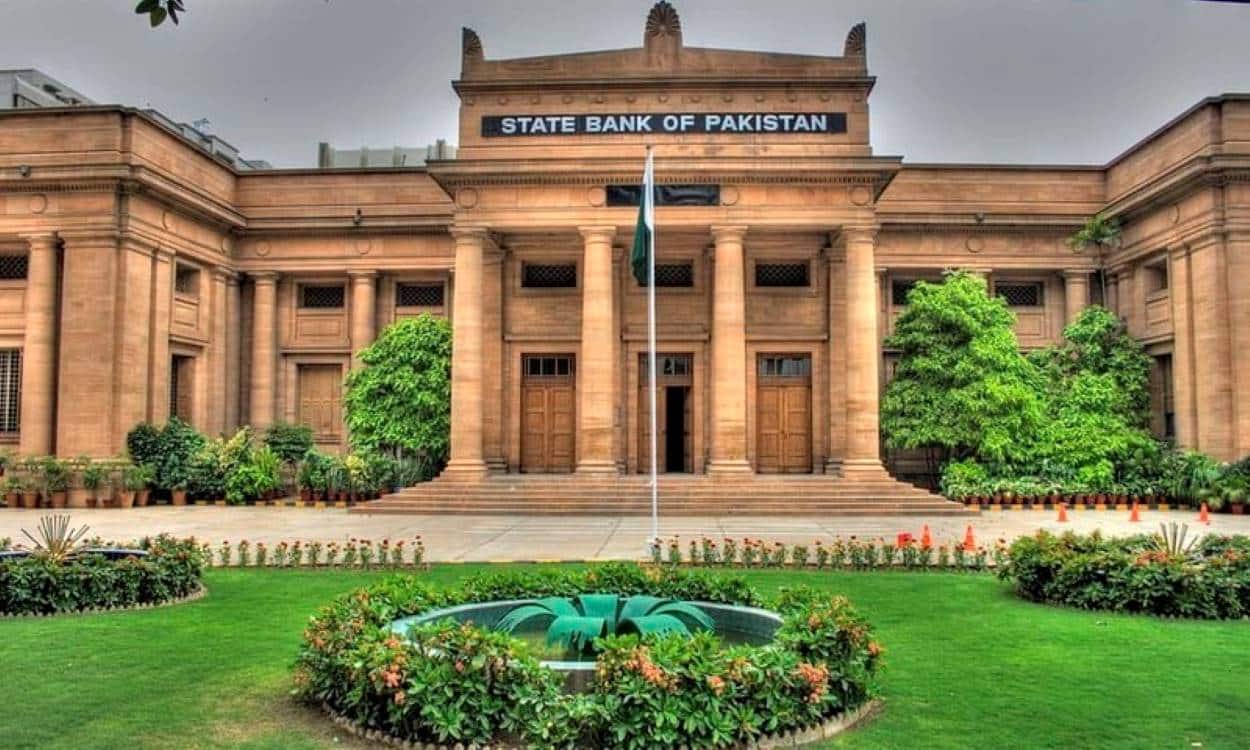

The State Bank of Pakistan (SBP) has decided to keep the policy interest rate unchanged at 10.5% for the next two months.

The decision was taken during the latest Monetary Policy Committee (MPC) meeting, held on Monday

The committee noted that headline inflation stood at 5.6% year-on-year in December 2025, in line with projections. Core inflation, however, stayed elevated at around 7.4% over recent months. Despite this, both consumer and business inflation expectations have continued to decline.

Recent high-frequency indicators show that economic activity is expanding faster than expected. Growth in large-scale manufacturing, vehicle sales, cement dispatches, and petroleum consumption reflects strong domestic demand.

Imports increased mainly due to higher volumes, while exports declined. This led to a wider trade deficit. However, the current account deficit remained contained due to strong workers’ remittances and favourable global commodity prices.

The MPC said the outlook for inflation and the current account remains broadly unchanged. At the same time, the growth outlook has improved significantly.

Based on this assessment, the committee concluded that maintaining the current policy rate would support price stability and sustainable economic growth.

Key Developments Since Last MPC Meeting

The committee highlighted several major developments:

- Real GDP growth for Q1-FY26 reached 3.7% year-on-year, driven by industrial and agricultural output.

- Foreign exchange reserves rose to $16.1 billion as of January 16, exceeding the December target, driven by SBP purchases in the interbank market.

- FBR tax growth slowed to 7.3% in December, falling below the target.

- The International Monetary Fund slightly raised its global growth forecast for 2026, while warning about trade tariffs and commodity price volatility.

Economic activity improved sharply compared to last year. Real GDP growth in Q1-FY26 rose from 1.6% to 3.7%. Large-scale manufacturing recorded growth of 8.0% in October and 10.4% in November 2025. Overall LSM growth reached 6.0% during Jul–Nov FY26.

Agricultural indicators also point to a strong wheat crop. This performance is expected to support services-sector growth. SBP now projects FY26 GDP growth between 3.75% and 4.75%, with further improvement expected in FY27.

External Sector Remains Manageable

The current account posted a $244 million deficit in December 2025, taking the H1-FY26 deficit to $1.2 billion.

Exports declined due to lower food shipments, particularly rice. Textile exports remained stable. Strong remittances and ICT exports helped limit pressure on the external account.

SBP expects the current account deficit to remain between 0–1% of GDP in FY26. Federal Board of Revenue (FBR) tax collection grew 9.5% in H1-FY26, well below last year’s pace. This resulted in a shortfall of Rs 329 billion.

While the fiscal balance improved due to lower interest payments, achieving the annual primary surplus remains challenging. The MPC stressed the need for tax reforms and privatization of loss-making state-owned enterprises.

Money, Credit, and Inflation Outlook

Broad money growth rose to 16.3% by January 9, driven by private sector credit and government borrowing. Private sector credit expanded by Rs 578 billion in FY26 so far.

The SBP also reduced the Cash Reserve Requirement from 6.0% to 5.0% to support lending.

Headline inflation eased in December due to lower food prices, though energy inflation rose. The MPC expects inflation to briefly exceed the target range before stabilising within 5–7% in FY26 and FY27.

The MPC stressed that sustained growth requires close coordination between monetary and fiscal policy. It also called for productivity-enhancing structural reforms to boost exports and ensure long-term economic stability.