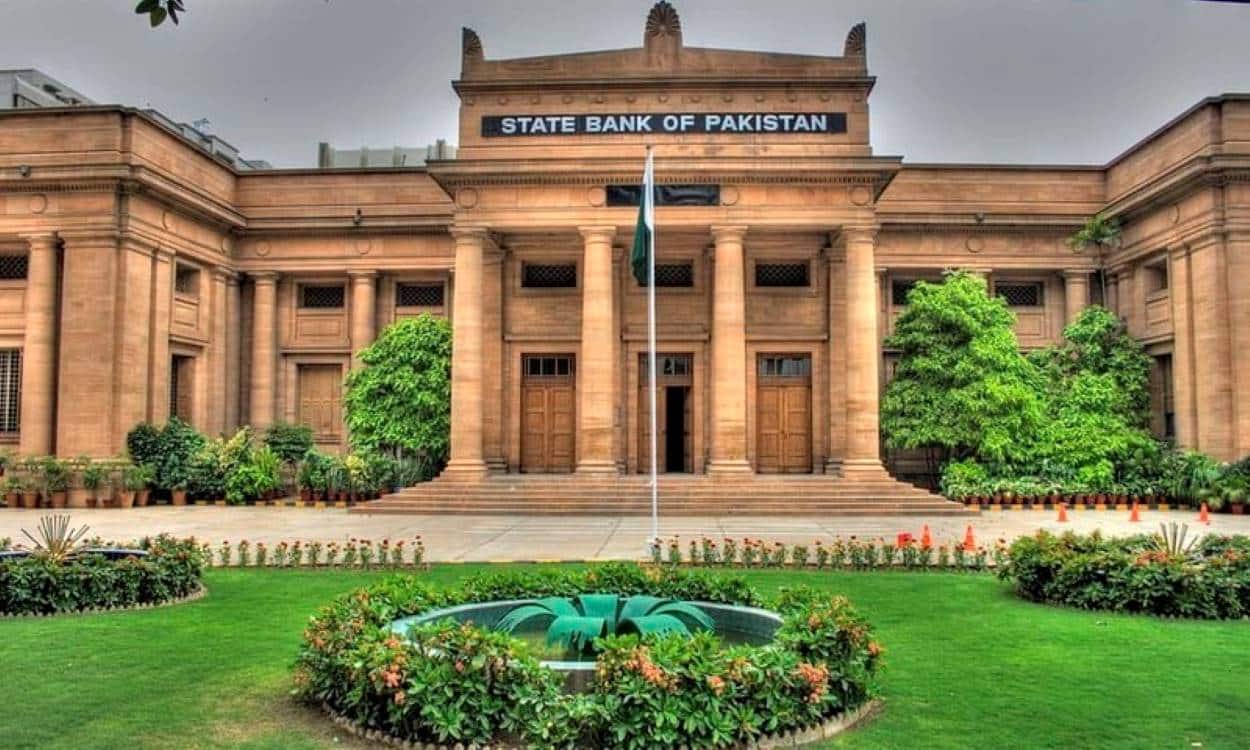

The State Bank of Pakistan (SBP) provided a briefing to the National Assembly Standing Committee on Finance and Revenue, projecting a GDP growth rate of 3.2% for the fiscal year 2026 (FY26). This figure is below the government’s official target of 4.2%, indicating potential economic challenges ahead. The meeting, chaired by Syed Naveed Qamar at Parliament House, addressed key issues such as foreign exchange reserves, inflation, and monetary policy.

The SBP projects Pakistan’s GDP growth for FY26 to reach 3.2%, falling short of the government’s target of 4.2%. Over the past decade, Pakistan has averaged around 3% GDP growth, reflecting persistent structural challenges.

Deputy Governor Dr. Inayat Hussain announced that foreign exchange reserves are expected to rise to $15.5 billion by December 2025 and to $17.5 billion by June 2026. He emphasised maintaining the rupee’s value at its current “right level” to prevent inflating the import bill, which could further strain reserves. Last fiscal year, the SBP purchased $7.8 billion from the open market, intervening only when excess dollar supply existed

The SBP warned that inflation may exceed its target between April and June 2026. The International Monetary Fund (IMF) has allowed a 1.2% value gap between the rupee and the dollar to manage currency stability. Remittances for FY26 are estimated at $40 billion. To counter a recent decline, the government reinstated an incentive scheme, offering banks 20 riyals per $200 transaction.

Committee member Sharmila Faruqui raised concerns about high interest rates amid persistent inflation. Dr. Hussain noted that the next monetary policy meeting, scheduled for September 15, 2025, will review these pressures. The SBP has maintained a steady policy rate, which has contributed to cautious market sentiment.

Chairman Syed Naveed Qamar criticised the Ministry of Industries and Production for not briefing the committee on the new electric vehicles policy’s carbon levy. He accused the ministry of misleading parliament. He stated, “The government thinks its job is done while parliament can go to waste.” The committee deferred further discussion on this topic.

The committee opposed the Securities and Exchange Commission of Pakistan’s (SECP) Corporate Social Responsibility (CSR) Bill 2025. The bill requires profit-making companies to allocate 1% of their net profits to social welfare activities. Naveed Qamar advocated for making it mandatory, while Minister of State Bilal Azhar Kayani argued it resembled a new tax. Members Hina Rabbani Khar, Mubeen Arif, and Dr. Nafisa Shah called for revisiting the bill in the next meeting.

The committee reviewed the 10% GST imposed in ex-FATA regions, noting conflicting lobbies in favour of and against the tax. Naveed Qamar clarified that the levy targets industrial imports and exports, but local residents oppose taxation on consumption. The Federal Board of Revenue (FBR) chairman suggested compensating residents through Benazir Income Support Programme (BISP) subsidies.

Pakistan’s economy faces ongoing challenges. Various institutions project FY25 growth between 2.5% and 3.5%. The IMF expects 3%, the World Bank 2.8%, and the Asian Development Bank 3%. The government’s FY26 target of 4.2% shows cautious optimism. This optimism relies on expected recoveries in agriculture and industry. However, external pressures such as debt repayments and trade imbalances continue to weigh heavily.