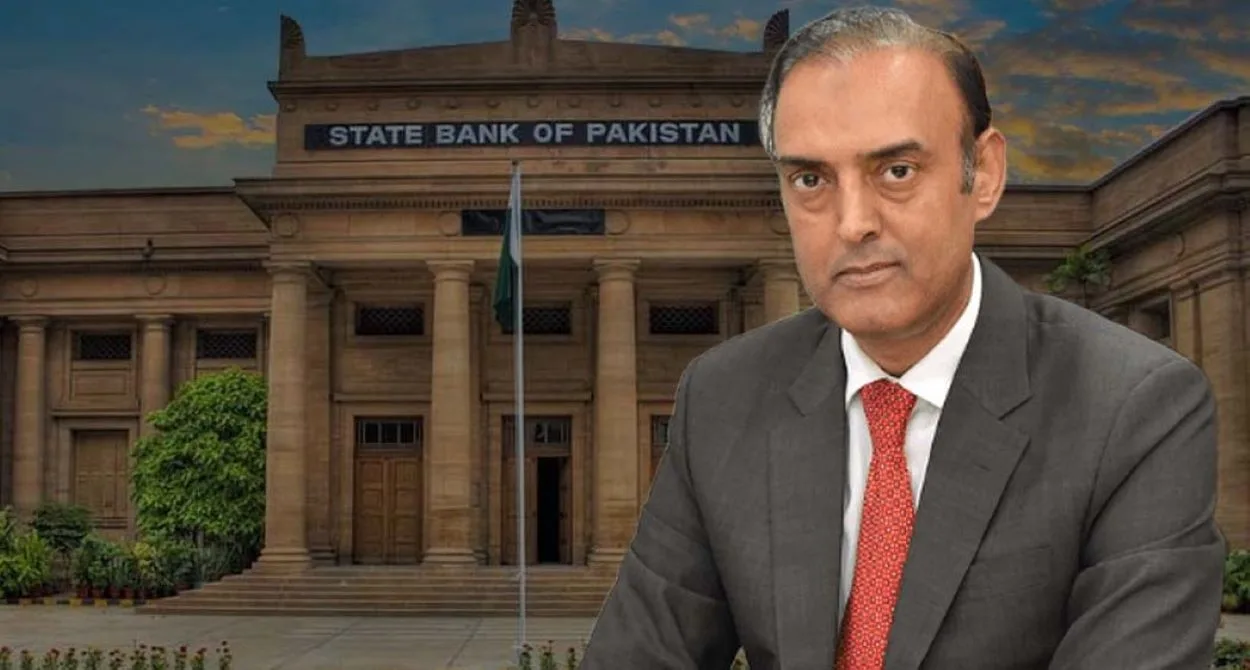

State Bank of Pakistan Governor Jameel Ahmad announced that transactions worth Rs 612 trillion occurred during fiscal year 2025. Surprisingly, branches still processed 77% of these transactions despite the push toward digital solutions.

The governor revealed these figures while addressing representatives from the banking sector. He emphasised the need for faster digital adoption across Pakistan’s financial landscape.

Governor Ahmad reported strong private sector adoption of the Raast digital payment platform. He confirmed that fifteen additional banks will soon integrate with the system, significantly expanding its reach. The SBP governor urged the Pakistan Banking Association to actively support this digital transition. He stressed that collaboration between institutions is essential for success.

Jameel Ahmad emphasised the crucial need to enhance public trust in digital financial services. He announced that the central bank is enhancing its cybersecurity framework to ensure the safety of transactions. The governor issued a stern warning about the impact of security breaches. “Even a single cyber fraud incident can undermine customer trust,” he stated, urging banks to invest in secure technologies.

Read: State Bank of Pakistan Holds Interest Rate at 11%

Governor Ahmad addressed the growing influence of artificial intelligence in the financial services sector. He explained that AI advancements have increased the industry’s responsibilities toward consumer protection. Maintaining public confidence in Pakistan’s digital financial ecosystem remains paramount. The governor emphasised the importance of protecting consumer privacy while embracing technological innovation.

Retail Payment Systems Show Strong Growth

Earlier SBP reports revealed impressive growth in retail payment volumes. The system recorded a 38% increase during fiscal year 2024-25, primarily driven by the adoption of digital channels.

Digital channels now account for 88% of all retail transactions. This shift demonstrates a change in consumer behaviour and an increasing comfort with digital financial solutions. The Raast instant payment platform more than doubled both its transaction volume and value. Meanwhile, PRISM+, the upgraded real-time gross settlement system, also achieved double-digit growth.