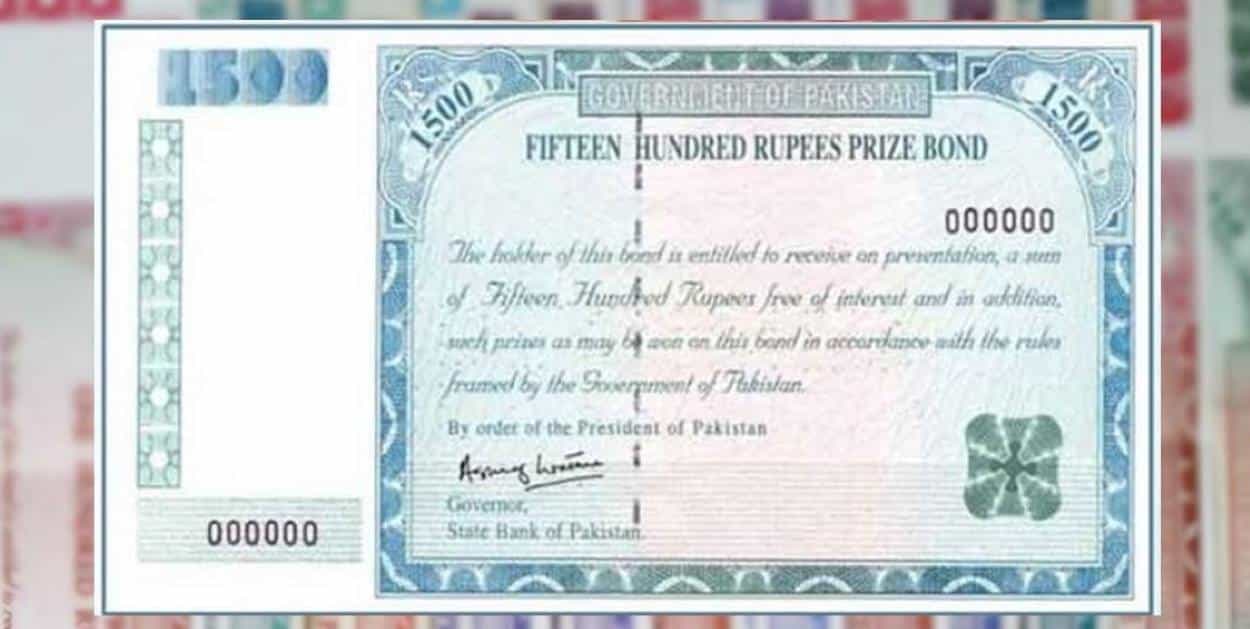

The Rs 1,500 prize bond draw will take place in Lahore on February 16, 2026, marking the first draw of this denomination for the year. The National Savings Centre in Lahore will host the event, drawing attention from thousands of prize bond holders across Pakistan.

Prize bond investors traditionally follow these draws closely, as they offer a chance to win significant cash prizes without risking the bond’s principal value.

Under existing rules, all Pakistani citizens are eligible to purchase prize bonds. Buyers can obtain bonds from State Bank of Pakistan Banking Services Corporation offices, authorised commercial bank branches, and National Savings Centres.

Purchasers must submit an application along with a copy of a valid Computerised National Identity Card. Authorities require this documentation to comply with financial regulations and record-keeping standards.

Prize money details for the draw

According to the State Bank, the Rs 1,500 prize bond draw offers several prize categories. The first prize carries a cash award of Rs3 million.

In addition, three second prizes of Rs 1 million each will be awarded. These prizes attract strong interest because the payouts significantly exceed the bond’s face value.

Read: Rs 1500 Prize Bond November 2025 Draw Results Announced

Third prizes and the number of winners

Alongside the top prizes, the draw includes many third prizes. A total of 1,696 third prizes will be given in this draw.

Each third-prize winner will receive Rs18,500. This structure ensures that many participants benefit from the draw, even if they do not secure the top prizes.

[Internal link: Prize bond results archive]

How to claim prize bond winnings

Winners can claim their prize money at any SBP-BSC field office, designated commercial bank branch, or National Savings Centre. Claimants must complete the prescribed claim form before receiving payment.

Authorities advise winners to keep their prize bonds safe and intact. Claims typically require verification of identity and the authenticity of the bond.

Prize bond winnings are subject to withholding tax under Pakistan’s revised tax policy. The tax rate depends on the winner’s filing status.

Tax filers face a 15 per cent deduction on prize money. Non-filers are taxed at 30 per cent, resulting in a significantly higher deduction from their winnings.