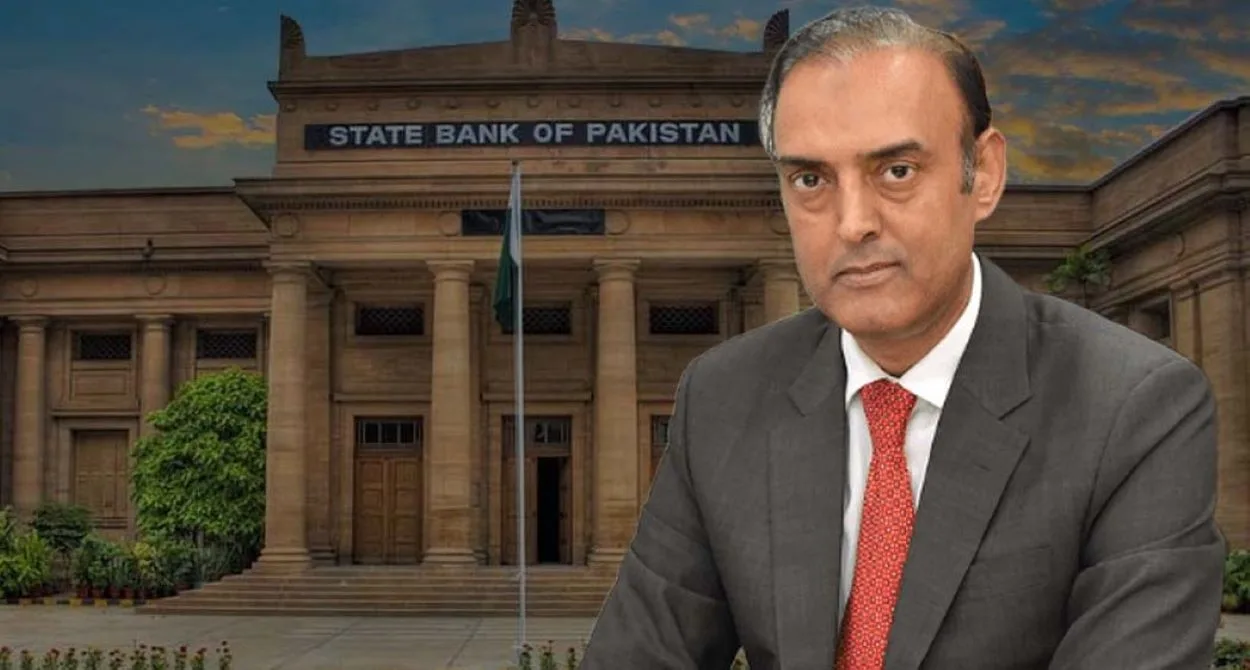

The State Bank of Pakistan (SBP) injected over Rs10 trillion into the money market through conventional and Shariah-compliant open market operations (OMOs). This move aims to stabilise liquidity and support economic activity amid global uncertainties.

In the conventional OMO (Reverse Repo Purchase), the SBP accepted bids worth Rs 9.61 trillion (face value) out of Rs 9.65 trillion offered. The realised value reached Rs. 9.23 trillion. Specifically, Rs407.85 billion went to the 7-day tenor, and Rs9.20 trillion to the 14-day tenor, both at an 11.01% rate of return.

Meanwhile, the Shariah-compliant Mudarabah-based OMO saw Rs387.5 billion injected (face value), with a realised value of Rs388.82 billion. This included Rs 294.5 billion for 7 days at an interest rate of 11.13% and Rs 93 billion for 14 days at an interest rate of 11.09%.

Read: Pakistan Plans $750M via Panda Bonds for Debt Repayments

The Pakistani rupee experienced a slight increase in the interbank market on Friday. It closed at 281.26 per US dollar, up one paisa from 281.27 the previous day. According to Ismail Iqbal Securities, the rupee has depreciated 0.96% year-to-date in calendar terms but appreciated 0.89% year-to-date in fiscal terms.

Despite a global surge in bullion prices, driven by a looming US government shutdown and expected Federal Reserve rate cuts, Pakistan’s gold market remained unchanged. The All-Pakistan Gems and Jewellers Sarafa Association reported gold at Rs 407,778 per tola and Rs 349,603 for 10 grams on October 3.

The SBP’s injection signals proactive monetary management. It addresses liquidity needs while the rupee’s stability supports trade. Gold’s steadiness, despite global spikes, reflects local market resilience. However, ongoing US economic concerns could influence future trends.