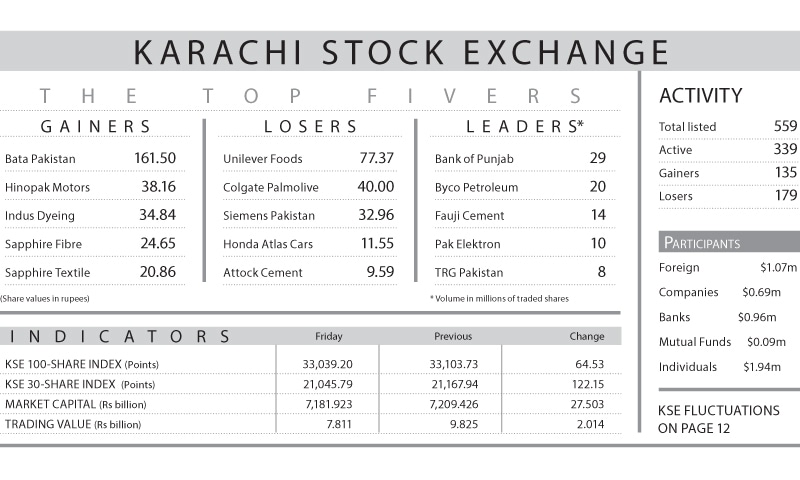

Karachi: The stock market remained range bound on Friday with the KSE-100 index closing down by 64.53 points or 0.19pc at 33,039.20.

In a dull session where institutional investors remained on the sidelines and individuals decided to take profit with sale of $1.94m worth stocks, the volume of shares traded stood depressed at 175 million of the value of $7.8 billion against 213m shares of trading value of $9.8bn the previous day.

Market participants complained of lack of triggers. The possible cut in Monetary Policy appeared to have been priced in while cement sector received a blow on Friday on announcement of anti-dumping duty by South Africa on cement imports.

Cement shares came under selling pressure as Lucky shed 0.34 per cent; DGKC fell by 1.54pc and ACPL declined by 4.62pc.

Oil sector remained depressed due to the recent decline in international oil prices as PSO and POL closed down by 1.1pc and 0.9pc, respectively.

In banking sector, BOP was up 5.7pc. Within the Auto sector rumours persisted about a possible decrease in duty on imported cars in the budget, thus hurting the local assemblers as HCAR, GHNL and INDU closed down by 4.8pc, 5pc and 0.4pc, respectively.

|

Analyst Ahsan Mehanti at Arif Habib Corp observed that the pre-budget uncertainty played a catalyst role in bearish activity at KSE ignoring reports of over Rs600bn PSDP commitments in the federal budget 2015-16.

Weekly reports of brokerage houses calculated loss of 491 points or 1.46pc in the KSE-100 index, indicating third straight week of negative closing.

No major changes for Pakistan in the MSCI index review, Karachi bus attack incident of May 13 and aggressive selling by local funds dampened market sentiments.