U.S. regulatory authorities have intensified their clampdown on the crypto industry, taking legal action against two prominent players in successive days.

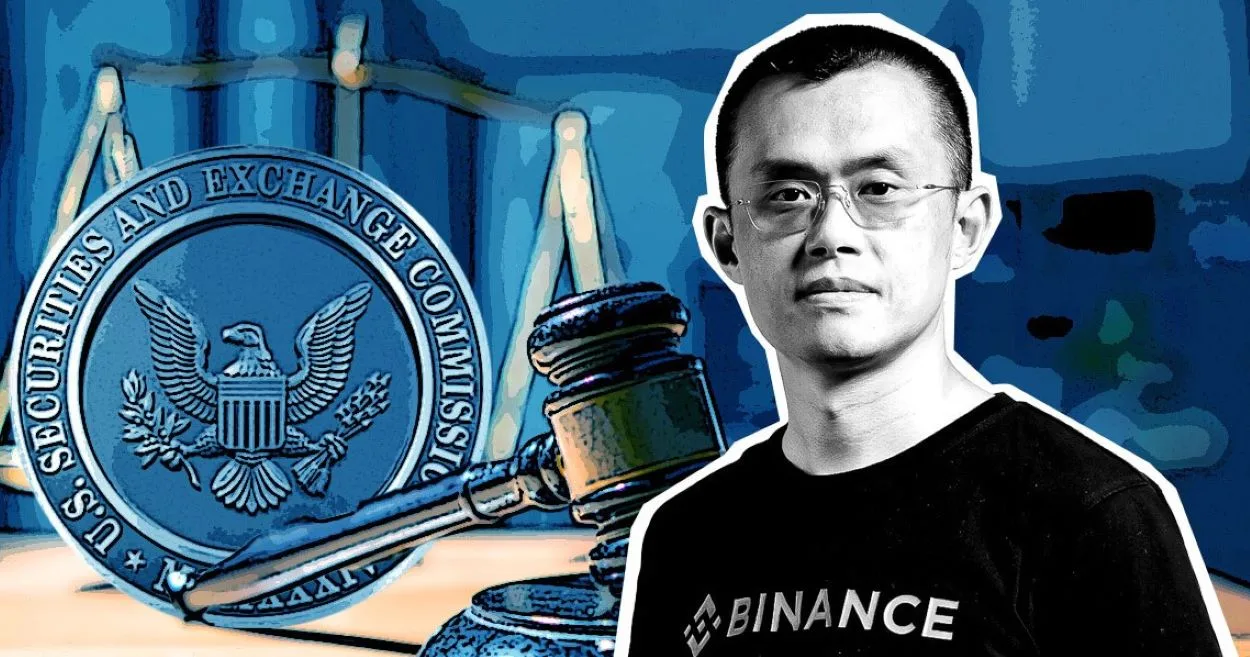

The Securities and Exchange Commission (SEC) has launched a lawsuit against Coinbase, a premier cryptocurrency platform, charging it with functioning as an unauthorized securities exchange and sidestepping regulations meant to safeguard investors. This comes on the heels of the SEC’s legal action against Binance, the world’s biggest crypto exchange, over several purported violations of securities laws.

If these lawsuits prove victorious, they could instigate considerable regulatory shifts in the crypto market, with the SEC asserting its dominance over cryptocurrencies that have long resisted classification as securities. Coinbase has already encountered the repercussions, experiencing notable customer withdrawals and a drop in its share value.

These actions by the SEC form part of a wider campaign to apply federal securities laws to cryptocurrencies. The regulatory body argues that tokens are securities and fall within its purview. This stance contrasts with the crypto industry’s position that tokens don’t fit the securities definition and shouldn’t fall under SEC regulation.

The lawsuits filed by the SEC against Coinbase and Binance showcase its increasingly assertive approach and commitment to ensuring industry compliance.

Accused of generating billions of dollars through facilitating unregistered trading of crypto asset securities, Coinbase, which boasts over 108 million customers, allegedly conducted trades without the required disclosure obligations to protect investors. The SEC is seeking civil penalties, recoupment of unlawful profits, and an injunction as part of the lawsuit.

Coinbase and other crypto firms claim that the SEC’s regulations are unclear and that the agency is exceeding its boundaries by attempting to regulate the sector. Nevertheless, in response to regulatory scrutiny, many firms have begun improving compliance and expanding their operations beyond the U.S. The lawsuit outcomes will greatly impact the crypto market, as a ruling favoring the SEC could reshape the industry and subject it to tighter regulations.

In summary, the SEC’s actions against Coinbase and Binance mark a crucial development in the ongoing confrontation between regulators and the crypto sector. The lawsuits underscore the growing regulatory scrutiny of crypto platforms and the potential for a pivotal shift in the crypto market’s regulatory landscape.