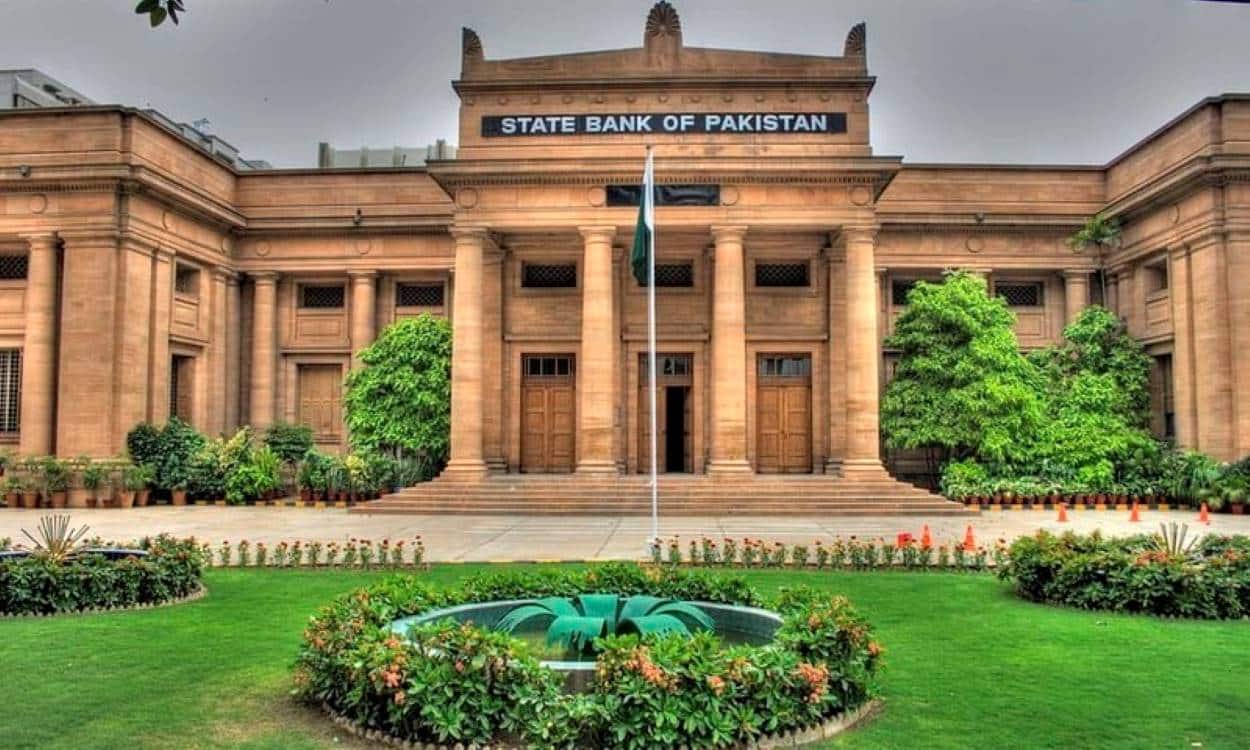

The State Bank of Pakistan is expected to lower its policy rate in its next meeting on Friday, September 12, potentially marking the third consecutive reduction.

Economists forecast a decrease of 1% to 1.5%, motivated by the recent drop in inflation to single digits in August to bolster the fiscal year 2024-25 economic activity.

The possibility of a larger reduction exists, considering the substantial difference between the State Bank of Pakistan’s (SBP) current policy rate and the recent inflation rate, resulting in a real interest rate of 10-11%. Typically, Pakistan has aimed for a real interest rate between 3-5% to buffer against inflation spikes.

Per the Express Tribune, Pakistan, Saad Hanif, Head of Research at Ismail Iqbal Securities, suggests that the SBP will likely adopt a gradual approach to rate cuts. He highlights two main factors influencing this strategy: the bank’s alignment with International Monetary Fund (IMF) recommendations amid negotiations for a $7 billion loan program and the risk of depleting foreign exchange reserves, which could destabilize the rupee. The rupee has been stable at Rs278-279/$ for more than five months.

Hanif anticipates a 100 basis point reduction in the upcoming decision. Previously, the SBP reduced the rate by 250 basis points across June and July, lowering it to 19.5% after a prolonged period at a record high of 22%.