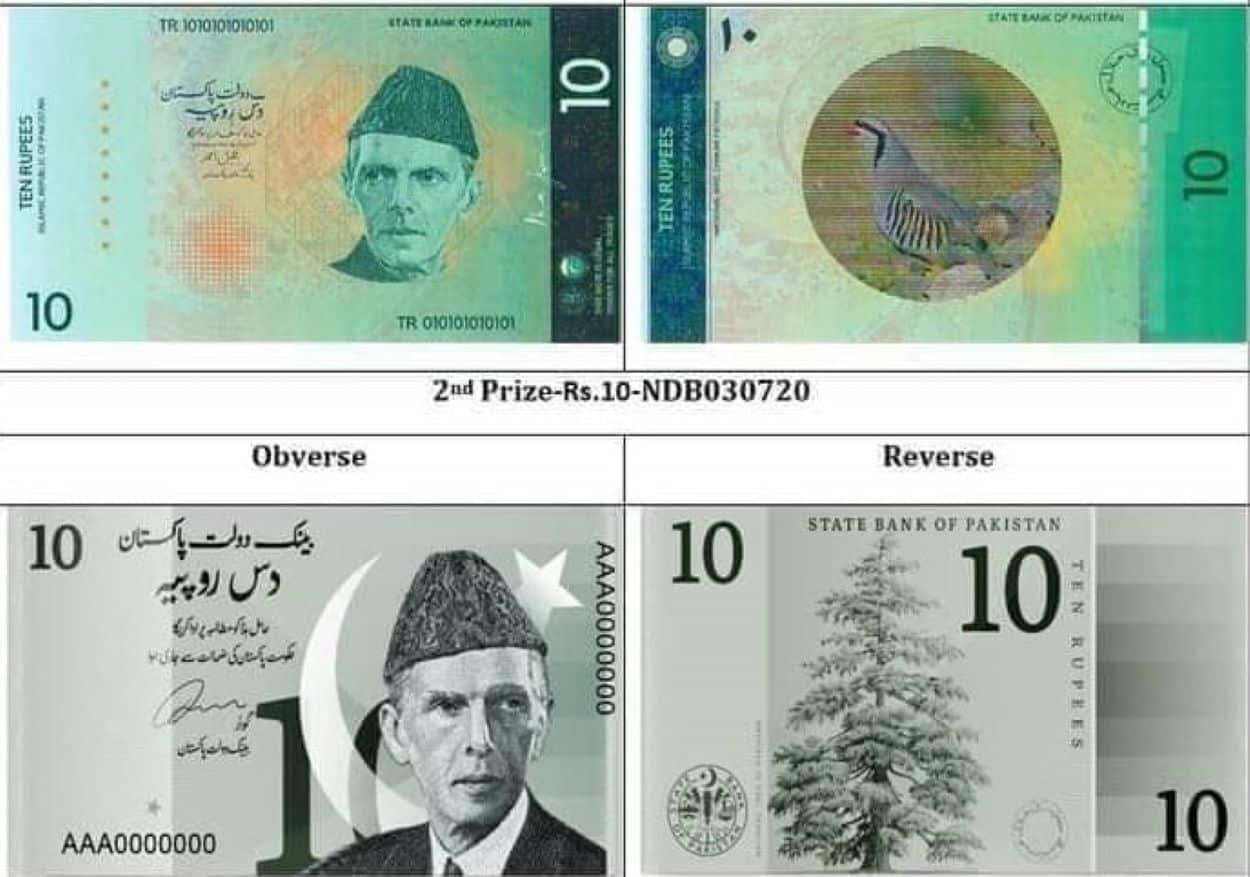

The federal government has approved plans to introduce new currency notes. This aims to modernise Pakistan’s cash system and strengthen protection against counterfeiting.

During a cabinet meeting, the Federal Cabinet of Pakistan formed a special committee to review and finalise the designs. Muhammad Aurangzeb, the Federal Minister for Finance, briefed cabinet members on the initiative.

He said the new designs will be introduced for the Rs100, Rs500, Rs1,000, and Rs5,000 denominations. The government has engaged international experts to ensure the notes meet modern global standards. According to the finance minister, the redesigned currency will include advanced security features to deter counterfeiting.

وزیراعظم محمد شہباز شریف کی زیرِ صدارت وفاقی کابینہ کا اجلاس

وفاقی کابینہ کو وزارتِ خزانہ کی جانب سے اسٹیٹ بینک آف پاکستان سے جاری ہونے والے بینک نوٹوں کے نئے ڈیزائن کے حوالے سے بریفنگ دی گئی۔ اجلاس کو بتایا گیا کہ نئے کرنسی نوٹوں کو جدید عصری تقاضوں کے حوالے سے ڈیزائن کیا جا… pic.twitter.com/PcV9ofLjXG

— Government of Pakistan (@GovtofPakistan) January 14, 2026The new notes will also highlight Pakistan’s cultural identity. Designs will showcase historical landmarks and reflect the country’s regional and geographical diversity. In addition, the currency will promote themes of women’s contribution to national development and raise awareness about environmental change.

Alongside currency reforms, the government is expanding cooperation in digital finance. Pakistan recently signed a memorandum of understanding with SC Financial Technologies LLC, an affiliated entity of World Liberty Financial. This aims to enhance collaboration in digital financial services.

The agreement was signed between the Ministry of Finance and SC Financial Technologies. The signing ceremony was attended by Asim Munir, underscoring the strategic importance of the partnership. In addition, a company delegation also met with Shehbaz Sharif to discuss future cooperation.

Under the agreement, Pakistan and World Liberty Financial will work on digital payment solutions. This includes cross-border systems to strengthen the fintech ecosystem and improve financial inclusion. Moreover, the government has decided to begin discussions on the potential use of stablecoins within Pakistan’s financial system.

Earlier, the Pakistan Virtual Asset Regulatory Authority issued no-objection certificates to Binance and HTX, allowing both platforms to initiate local incorporation. The regulator said the approvals followed a review of governance and compliance controls. This enables the companies to register under anti-money laundering systems and prepare full licence applications.