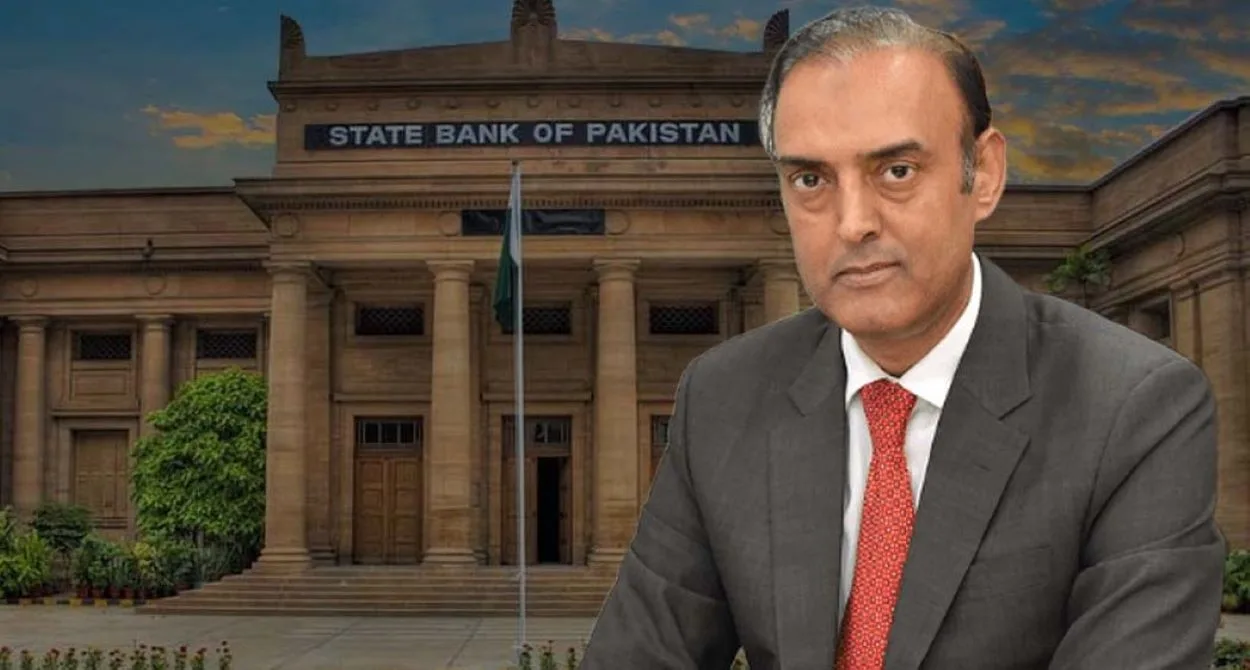

Jameel Ahmad, Governor of the State Bank of Pakistan, announced a reduction in inflation to 20.7% in March 2024, marking the lowest rate in two years from a peak of 38% in May 2023.

During briefings for international investors in Washington, D.C., Governor Ahmad shared these developments, highlighting the stabilization of Pakistan’s external sector due to a dramatic decrease in the current account deficit, which narrowed to $1 billion from July to February of fiscal year 2024, down from $3.8 billion in the corresponding period last year.

In addition to private briefings, Governor Ahmad participated in events hosted by major global financial institutions such as J.P. Morgan, Citibank, and Jefferies. These events were part of the spring meetings of the International Monetary Fund (IMF) and World Bank. During these engagements, he discussed the notable enhancements in Pakistan’s economic landscape over the past year, attributed to careful monetary strategies, fiscal consolidation, and the launch of key structural reforms.

Furthermore, a recent IMF World Economic Outlook Report for 2024 forecasts a decline in inflation and unemployment for Pakistan.

The IMF projects Pakistan’s economic growth rate will rise to over 3.5% next year, with this year’s growth anticipated at 2%. Inflation is expected to taper to 24.8% this year and further reduce to 12.7% next year, while unemployment is also expected to decrease from 8% this year to 7.5% next year.

Julie Kozack, the IMF’s Communications Director, affirmed the positive trajectory during a press conference. She noted that a staff-level agreement reached on March 19 would allocate $3 billion to Pakistan, and an IMF board meeting is anticipated by the end of the month.

Kozack commended the efforts of Pakistan’s new government toward implementing economic reforms and disclosed that the IMF is prepared to discuss a new program with Pakistan in the upcoming months, acknowledging the country’s improved economic and financial conditions since the first review.