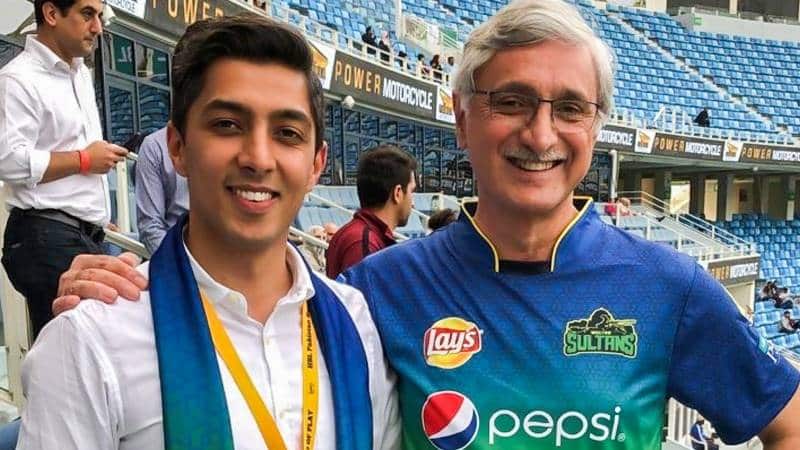

The Federal Investigation Agency (FIA) claimed a lack of “incriminating evidence” was why the local court rejected the money laundering case against sugar mogul Jahangir Khan Tareen and his son Ali Tareen Friday.

Based on the agency’s report, the judicial magistrate issued orders in the Rs 2 billion laundering case.

The FIA investigation officer (IO) stated that no money laundering was found and that all transactions were in line with Securities and Exchange Commission of Pakistan legislation (SECP).

The officer claimed it was a civil issue because it was an investment. He said that the accused could give documentary evidence for all transactions, and no monies were located.

The court quashed the father-son FIR after the IO’s report.

Two cases were filed against the Tareens on March 22, 2021, under sections 406 (criminal breach of trust), 420 (cheating of public shareholders), and 109 of the Pakistan Penal Code (PPC), coupled with sections 3/4 of the Anti Money Laundering Act.

The sugar baron allegedly stole shareholder money after his JDW group business moved Rs3.14 billion to a private allied company, Farooqi Pulp Private Limited (FPML). The FIR said his kids and close relatives own the private company.

“The transfers, notably after FY 2011-2012, were fraudulent investments which ultimately resulted in personal benefits for the family member of the JDW CEO,” the FIR said.

Tareen, his son, and other family members bought US$ from Lahore’s open market “structurally” during this time.

“In 2016, Ali Khan Tareen sent about US$7.4 Million to the United Kingdom for purchasing properties which makes them accountable for Anti-Money Laundering inquiry,” it stated.

according to the FIA, Tareen, his son, son-in-law Waleed Akbar Faruki, and Shahid Akbar Faruki controlled and profited from FPML

In the second FIR, the investigative agency alleged: “voluminous withdrawals amounting to at least Rs2.2 billion were fraudulently and dishonestly conducted through a trusted cash rider.” Amir Waris, JDW’s Corporate Head Office cashier, placed substantial amounts into Tareen’s and his family’s personal and commercial accounts.

“Cash-based misappropriation and money laundering were utilized to break the onward money trail of payments into personal and company accounts of the accused Tareen and family,” it stated.