Intel Corporation is emerging as a strategic investment linked to the resurgence of US semiconductor manufacturing, according to a recent investor letter from the Alpha Wealth Insiders Fund. Some investors now see Intel as a leveraged play on the “onshoring” of chip production and the broader shift in US industrial policy.

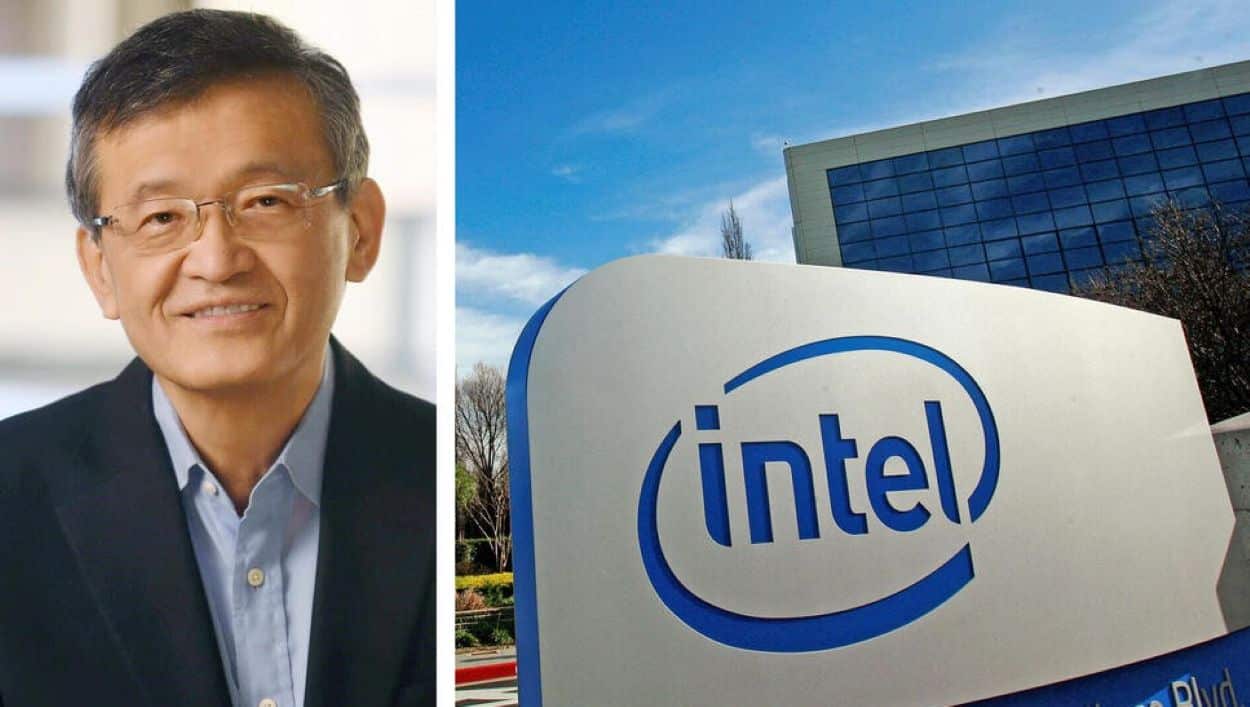

The view reflects Intel’s ongoing restructuring under Chief Executive Officer Lip-Bu Tan. The strategy focuses on sharpening the company’s core chip design capabilities while rapidly expanding its foundry business, which manufactures semiconductors for external clients.

The fund highlighted Intel’s recent sequential revenue growth and its participation in government-backed manufacturing projects. These initiatives position the company to directly benefit from policies that encourage domestic chip production, including incentives under the CHIPS Act.

At the same time, the investor letter urged caution. While Intel offers meaningful upside, the fund noted that some AI-focused stocks may provide a more attractive risk-reward balance for investors seeking faster exposure to artificial intelligence growth.

The U.S. has long been home to Intel’s leading R&D and product design and manufacturing. We’re proud to build on that legacy to deliver the next generation of innovation at Fab 52. #IntelTechTour #IntelInvestsInUS pic.twitter.com/enOF1BAzG4

— Intel Policy (@IntelPolicy) December 30, 2025Intel’s share price reflects that tension. The stock has surged nearly 100 per cent over the past year, underscoring renewed optimism, but it has slipped slightly in the most recent month. The move has reignited debate over whether the rally fully captures Intel’s potential or still leaves room for further upside.

Market analysts say Intel’s transformation rests on two parallel tracks. The first involves a renewed emphasis on advanced chip design, an area where the company aims to regain technological leadership. The second is the large-scale expansion of Intel Foundry Services, which allows Intel to earn revenue not only from selling its own chips but also from manufacturing designs for other firms.

This dual model could unlock long-term value, especially as federal funding helps offset capital costs. However, execution risks remain significant. Building and modernising fabrication plants requires time and heavy investment, while competition remains intense from NVIDIA in chip design and TSMC in contract manufacturing.

Although Intel reported a six per cent sequential revenue increase in the third quarter of 2025, analysts continue to watch margins, cash flow, and project execution closely.

Compared with high-growth AI pure-play stocks, Intel’s valuation appears more conservative for a company central to US semiconductor strategy. Ultimately, investors say its long-term value will depend on consistent delivery across both design and manufacturing. For now, Intel represents a patient, strategic bet on the future of American chipmaking.