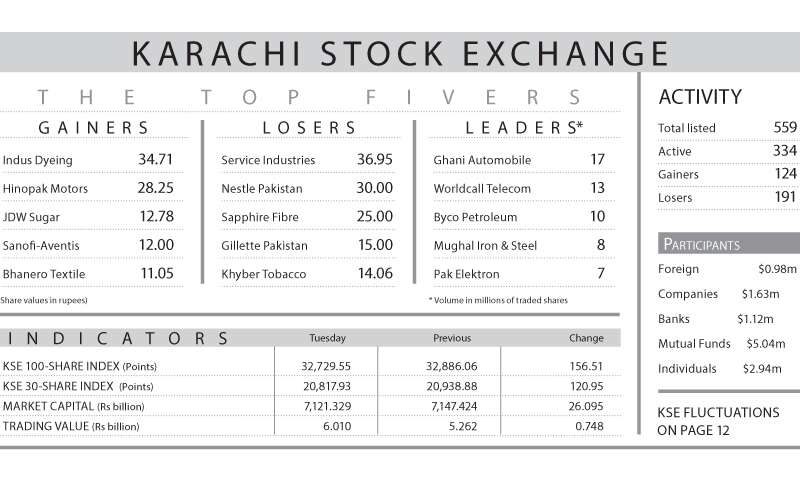

Karachi: Shares could not shrug off jitters over budget uncertainties and drifted down by 156.51 points (0.48 per cent) on Tuesday to 32,729.55.

Foreign investors again went on cherry-picking of stocks worth $0.98 million.

- Traded volumes increased by 16pc to 136m shares of Rs6 billion value, compared to earlier day’s volume of 117m shares and value at Rs5.3bn. Small cap stocks were mainly among the high volume stocks.

Ahsan Mehanti at Arif Habib Corp said sentiments remained bearish amid thin activity on concerns of imposition of GIDC, which is likely to impact corporate sector earnings outlook.

Oil stocks were battered on falling global crude prices. Pre-budget concerns and uncertainty over SBP policy rate stance played a catalyst role in bearish activity.

Equity sales desk at a major brokerage house stated that stock prices were impacted by low activity and fear of more taxes in the budget.

Umair Hasan at JS Global observed that the market raced to intra-day high by 165 points early in the morning. However, the positivity translated into a bull-trap as the market was quick to correct itself.

|

Cements remained under pressure mainly due to the anti-dumping duty on imports from Pakistan announced by South Africa last week. DGKC, FCCL, LUCK, MLCF closed lower by 0.9pc, 0.9pc, 1pc and 0.7pc.

Moreover, expectations of an increase in import duty on milk powder added the pressure on the food sector primarily on EFOODS. Banks also remained largely under pressure.

“The government is expected to pass long-awaited GIDC, to add pressure on fertilisers, cements and the power sectors. EFERT, ENGRO, FFC and ICI, all ended significantly lower,” analyst said.