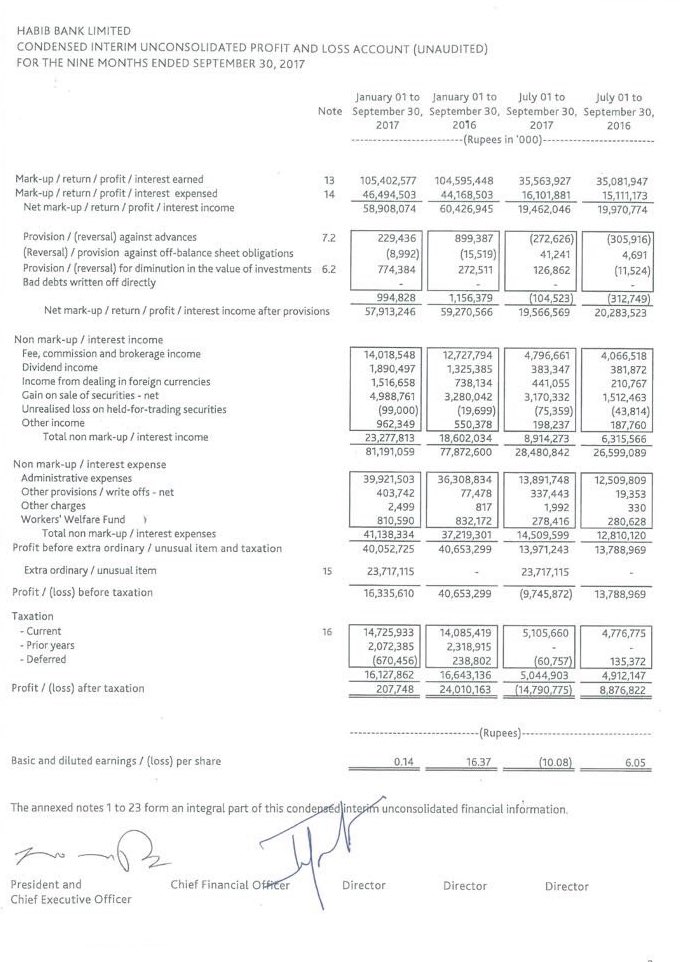

Habib Bank Limited (HBL) profit for the first three quarters FY 2017 has gone down to Rs. 1.6 billion following the penalty by the New York State Department of Financial Services (DFS).

The New York State Department of Financial Services (DFS) had fined Habib Bank $225 million for failures to comply with laws and regulations designed to combat illicit money transactions.

The DFS statement followed an announcement by the regulator August 2017 that it was seeking to fine Pakistan’s biggest lender, known as HBL, up to $630 million for “grave” compliance failures relating to anti-money laundering and sanctions rules at its only U.S. branch.

Read:HBL faces penalty over Rs66 billion, decides to shutdown operations in New York

DFS also imposed an order outlining conditions for the orderly closure of HBL’s New York branch. These conditions were included an investigation of transactions processed by the branch from October 2013 to the end of September 2014, and from April 2015 through the end of July 2017.