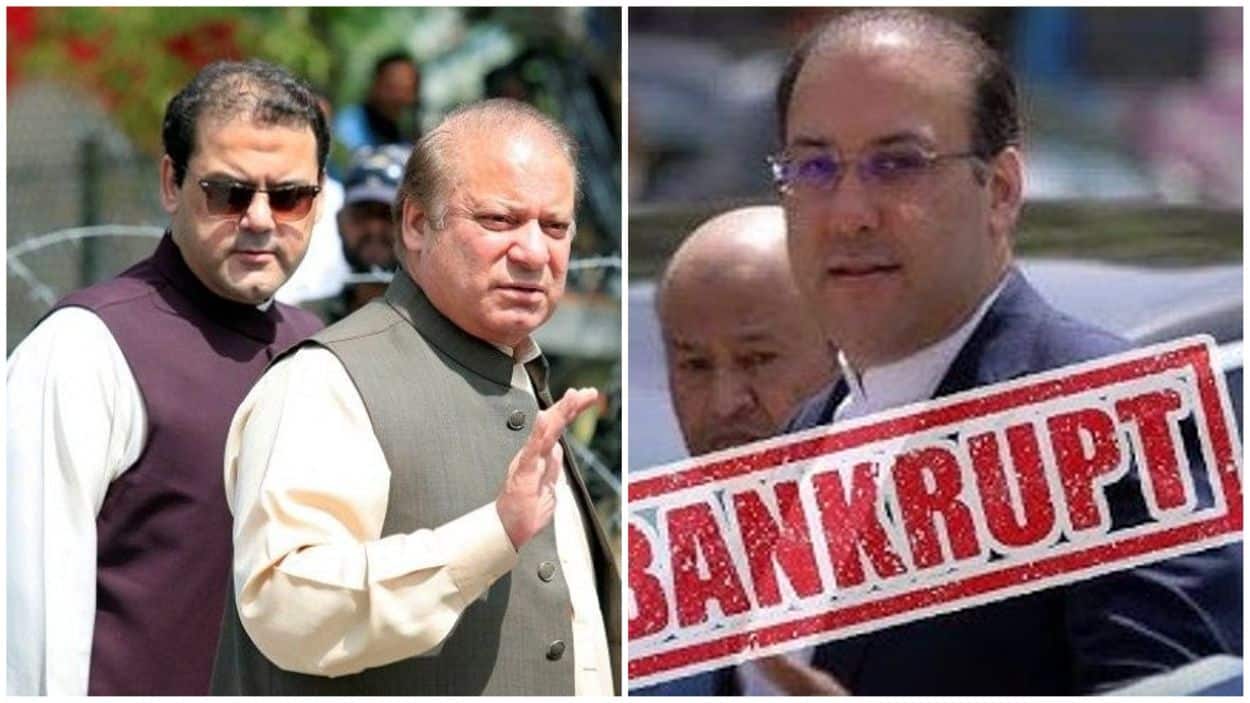

Hassan Nawaz, the son of former Pakistani Prime Minister Nawaz Sharif, has experienced a collapse of his UK business operations, leading to the dissolution of all seven of his companies and a bankruptcy declaration in April 2024.

As reported by The News International, once a director of ventures like Flagship Investments Limited, Nawaz faced a £5.2 million tax penalty from HM Revenue and Customs (HMRC), marking a significant downfall for the Sharif family’s UK financial footprint amid ongoing legal and financial troubles.

Hassan Nawaz, who previously managed seven companies, no longer holds directorships. Four companies were dissolved on December 3, 2024, one in December 2016, and two, Flagship Investments Limited and Quint Paddington Limited, are set to be struck off on May 20, 2025. Declared a tax defaulter, Nawaz’s bankruptcy followed HMRC’s enforcement actions, imposing a £5.2 million fine.

Read: Hasan Nawaz Named Among UK’s Deliberate Tax Defaulters

Flagship Investments Limited, a high-profile venture, and Quint Paddington Limited, operational since 2007, are among the dissolved entities, signalling the end of Nawaz’s UK business era. The closures, detailed in Companies House records, reflect financial mismanagement and regulatory pressure, with HMRC’s actions dismantling his portfolio.

Context and the Sharif Family Troubles

The collapse follows years of legal challenges for the Sharif family, including Nawaz Sharif’s conviction in 2017 for the Panama Papers, which led to his disqualification as prime minister. Hassan’s UK troubles, intensified by HMRC’s tax investigations, add to the family’s financial and political woes, including the bankruptcy, and broader anti-corruption efforts. After the May 10, 2025, Pakistan-India ceasefire, the timing shifts focus to domestic political dynamics, where the Sharifs’ influence remains contentious.

Hassan Nawaz’s bankruptcy and business dissolution underscore the vulnerability of high-profile figures to international regulatory scrutiny, impacting the Sharif family’s global standing. The case highlights HMRC’s aggressive tax enforcement, potentially deterring similar ventures.