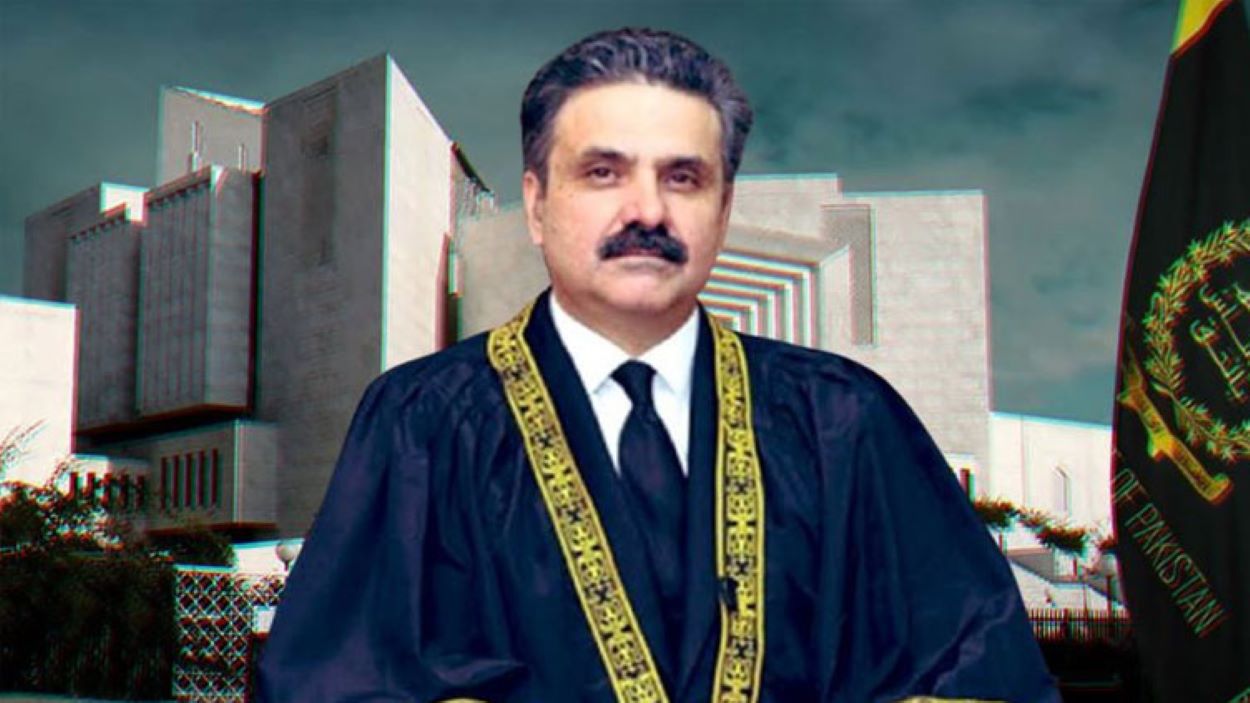

Chief Justice of Pakistan Justice Yahya Afridi on Saturday warned that prolonged tax litigation is squeezing fiscal space. It is also undermining investor confidence, with direct consequences for economic stability.

He made the remarks while chairing a high-level meeting at the Supreme Court of Pakistan. The meeting aimed to review reform proposals to expedite the disposal of high-impact tax cases with significant implications for the national economy.

The chief justice said the judiciary remains fully committed to supporting measures that promote timely justice, efficiency, and predictability. He stressed that these principles are especially critical in cases linked to economic outcomes and public revenue.

Participants discussed several reform-oriented strategies to reduce delays. These included prioritising and fast-tracking high-value tax disputes. Additionally, they focused on improving coordination between tax authorities and courts, strengthening legal preparedness, and enhancing case management practices. The meeting also explored procedural and institutional options to ensure consistent and faster adjudication.

The session was part of a broader justice-sector reform agenda. This agenda focused on improving governance, reducing systemic delays, and aligning judicial processes with Pakistan’s economic and development goals.

Justice Miangul Hassan Aurangzeb, the chairman of the Federal Board of Revenue, and other senior officials attended the meeting. Participants held detailed discussions. They discussed building a sustainable institutional framework to resolve long-pending and high-value tax cases, reduce litigation backlogs, strengthen legal certainty, and safeguard public finances.