Advanced Micro Devices (AMD) announced on Thursday that it will commence mass production of a new Artificial Intelligence (AI) chip, the MI325X, in the fourth quarter of this year to strengthen its position in a market led by Nvidia.

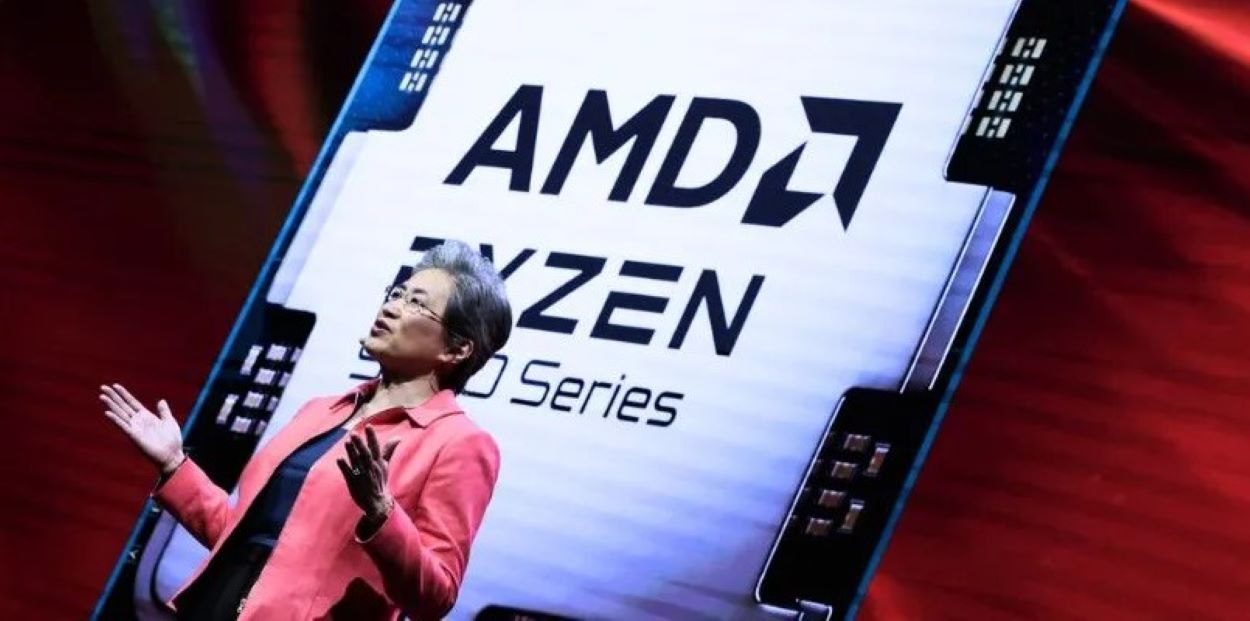

At a San Francisco event, AMD CEO Lisa Su revealed the company’s strategy to launch the next-generation MI350 series chips in the latter half of 2025. These chips will feature enhanced memory capacity and a novel architecture designed to outperform the existing MI300X and MI250X models significantly.

Despite these developments, AMD’s shares fell nearly five percent in afternoon trading, a drop analysts attribute to the lack of announcements regarding substantial new cloud-computing clients for these chips. In contrast, shares of Nvidia rose by 1.5 percent, and Intel’s dropped by 1.6 percent.

The growing demand for AI processors from major tech firms like Microsoft and Meta Platforms has outstripped the supply capabilities of both Nvidia and AMD, creating a sellers’ market for these semiconductor giants. This demand surge has propelled a notable rally in chip stocks, with AMD’s shares climbing about 30 per cent since an early August low.

Kinngai Chan, a research analyst at Summit Insights, noted the absence of new customer announcements at the event despite prior stock gains fueled by expectations of fresh developments.

AMD, based in Santa Clara, California, also announced that vendors such as Super Micro Computer would start distributing its MI325X AI chip to clients in early 2025. This chip, designed to rival Nvidia’s Blackwell architecture, incorporates a novel memory type to expedite AI calculations.

AMD’s upcoming AI chips are expected to increase competitive pressures on Intel, which has struggled to articulate a clear AI chip strategy. Intel projects its AI chip sales to exceed $500 million in 2024.

At the same event, Su mentioned that AMD is not planning to expand its use of contract chip manufacturers beyond Taiwan’s TSMC for its advanced manufacturing processes. She expressed interest in utilizing additional capacity outside Taiwan, particularly highlighting the use of TSMC’s facility in Arizona.

Additionally, AMD introduced several networking chips designed to enhance data transfer within data centres and unveiled a new server CPU family, formerly codenamed Turin. This includes a chip optimized to support GPU data processing for AI applications, featuring nearly 200 processing cores priced at approximately $14,813.

The company also launched three new PC chips for laptops based on the Zen 5 architecture, optimized for AI applications and compatible with Microsoft’s Copilot+ software.

Following heightened demand for its MI300X chips amid the generative AI boom, AMD adjusted its AI chip revenue forecast in July to $4.5 billion for the year, up from $4 billion.

For this year, analysts project AMD’s data centre revenue to be approximately $12.83 billion, with Nvidia expected to generate around $110.36 billion in data centre revenue. This revenue indicates the need for AI chips that are essential for developing and operating AI applications. Despite the share price surge, AMD and Nvidia maintain valuations at over 33 times their 12-month forward earnings, compared to the S&P 500’s average of 22.3.