The State Bank of Pakistan (SBP) held its key policy rate at 22%, despite market anticipations of an increase following guidelines from the International Monetary Fund (IMF).

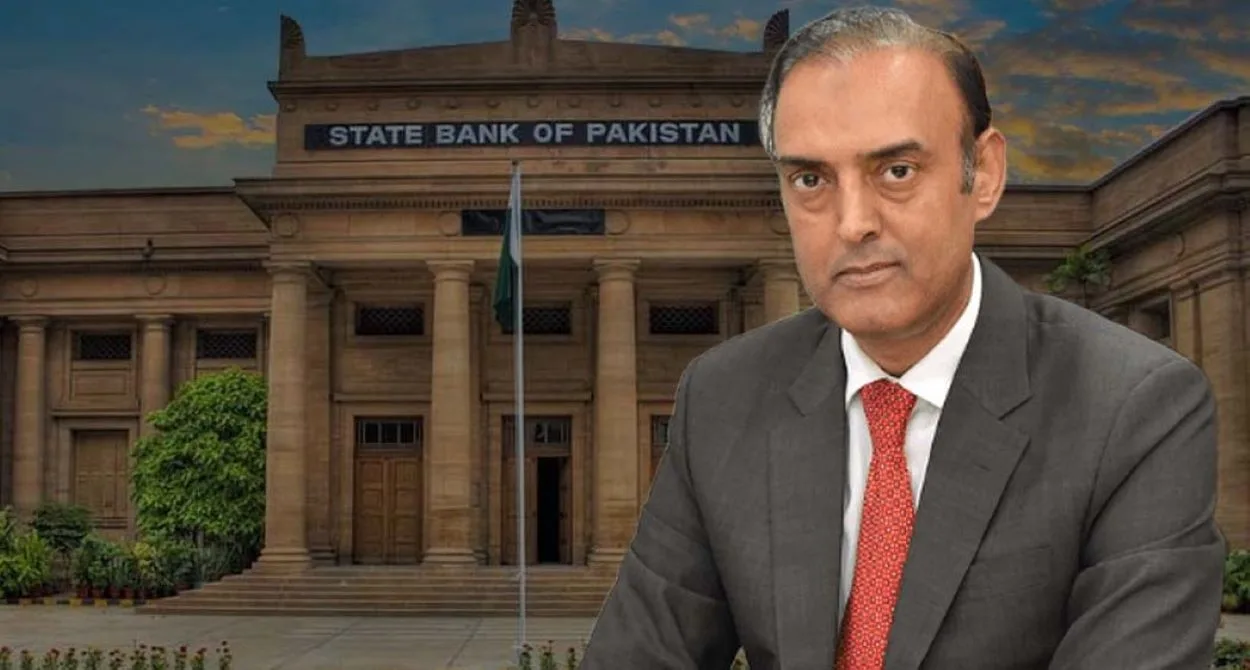

SBP Governor, Jameel Ahmed, announced the decision post the Monetary Policy Committee (MPC) meeting, attributing the choice to a downward trend in inflation.

A Look at Pakistan’s Economic Outlook

During a press briefing, Governor Ahmed outlined the country’s economic projections. He anticipates the growth rate to hover around 2% to 3% in the forthcoming year. Furthermore, the government lifted import restrictions, bolstering the nation’s foreign exchange reserves by $4.2 billion in July. This increase is attributable to funds from the IMF and other supportive nations.

Governor Ahmed highlighted the SBP’s foreign exchange reserves, which currently stand at $8.2 billion, are expected to strengthen further by December this year. More loans will be rolled over in the coming months. The MPC expects inflation to continue decreasing, despite the bank increasing the key policy rate by 12.25 percentage points since April 2022 to control rising inflation.

The SBP’s efforts in June to stabilize rates were met with success, with inflation peaking at 38% that month. But, by month’s end, an emergency meeting saw a 100bps rate increase to secure IMF funds given a “slightly deteriorated inflation outlook”.

The SBP’s policy approach has been somewhat influenced by IMF’s urging Pakistan to continue its monetary tightening cycle, expressed earlier in July. This occurred a week after approving a new $3 billion bailout deal with Pakistan, significantly assisting in averting a potential debt default.

MPC’s Outlook on Inflation and Economic Development

The MPC started the meeting, noting an overall decrease in economic uncertainty and improvement in investor confidence. While acknowledging some potential risks to inflation, it emphasized the delayed impact of accumulated monetary tightening, budgeted fiscal consolidation, and a subdued growth outlook for FY24.

The Committee anticipates year-on-year inflation declining over the next 12 months, suggesting a significant positive real interest rate. It also highlighted major developments since its last meeting in June that have shaped the short-term macroeconomic outlook.

Pakistan secured a nine-month Stand-By Arrangement (SBA) with the IMF, alleviating immediate external sector stability concerns and augmenting foreign exchange reserves. Additionally, the government has declared an increase in electricity tariffs, which will likely contribute to inflation in the future.

Global commodity prices have risen slightly but remain lower than their recent peak. Meanwhile, the IMF’s July 2023 World Economic Outlook modestly increased its global growth projection for the year, leaving the 2024 projection unaltered.

In response to these factors, the MPC maintained its tight monetary policy stance with positive real interest rates, striving to manage inflation and meet its medium-term inflation target of 5-7% by the end of FY25.