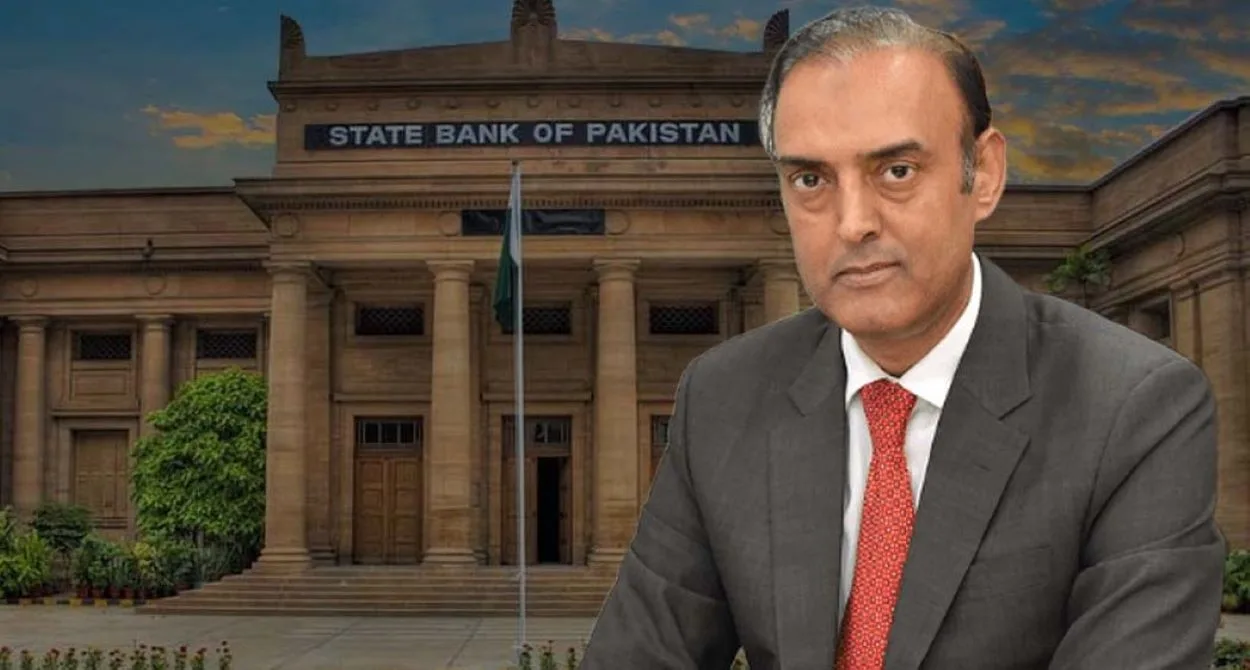

State Bank of Pakistan (SBP) Governor Jameel Ahmad recently confirmed Pakistan’s strong position to meet the IMF’s end-September objectives for net international reserves (NIR) and net domestic assets (NDA).

SBP Governor’s statement came during his interaction with major international investors at events coordinated by renowned banks such as Barclays, JP Morgan, Standard Bank, and Jefferies, coinciding with the IMF-World Bank conferences in Marrakech, Morocco.

Macroeconomic Developments and Challenges

The governor shared insights on Pakistan’s current economic trends, strategies implemented to address present-day challenges, and the country’s financial forecast. He emphasized that the SBP’s current policies aim to rectify macroeconomic disparities, focusing on achieving stabilization. Despite being proactive in tightening its monetary policy in response to global inflation surges, the SBP faced unforeseen domestic challenges, especially the 2022 floods, which hampered its anti-inflationary endeavours. Nevertheless, the governor pointed out the promising decline in inflation rates from a peak of 38.0% in May 2023 to 31.4% in September 2023, forecasting further reductions in the subsequent months.

Inflation and Foreign Exchange Reserves

Elaborating on the state’s financial health, Governor Ahmad noted that Pakistan anticipates a significant drop in inflation during the latter half of the fiscal year. He expressed confidence in the IMF’s Stand-By arrangement, asserting its potential to augment existing strategies for economic stabilization. The governor proudly highlighted the improvement in foreign exchange reserves from $3.1 billion in January 2023 to $7.6 billion by September 2023, attributing this growth to non-debt inflows in a conducive market setting. He underlined the reduction in the SBP’s forward foreign exchange liabilities, asserting that the bank has comfortably surpassed the IMF’s end-September targets.

Long-Term Growth and IMF Tranche

Emphasizing Pakistan’s dedication to rectifying longstanding structural vulnerabilities, the governor expressed optimism for sustainable and inclusive economic development in the forthcoming years, given continued support from international partners. A recent report from Topline Securities reflected similar optimism, predicting Pakistan’s receipt of the upcoming tranche from the $3 billion IMF Stand-By arrangement despite potential missed deadlines. The report affirmed Pakistan’s fulfilment of certain key targets by June 2023 but also drew attention to a few unmet benchmarks. In closing, the governor reaffirmed Pakistan’s commitment to its agreement with the IMF, which involves disbursing the remaining $1.8 billion in two phases following reviews in November and February based on specific performance indicators.