The Reserve Bank of India (RBI) has taken decisive action against New India Co-operative Bank, headquartered in Mumbai, following the detection of significant financial irregularities. The central bank’s stringent measures include barring the bank from issuing new loans and accepting deposits to safeguard depositor interests.

Effective February 13, 2025, New India Co-operative Bank faces several operational constraints imposed by the RBI. These include:

- A prohibition on granting new loans or renewing existing ones.

- Restrictions on accepting fresh deposits or making investments.

- A freeze on disbursing any payments.

- A ban on selling or disposing of any assets.

These measures will last six months, underscoring the RBI’s commitment to stabilizing the bank’s financial health.

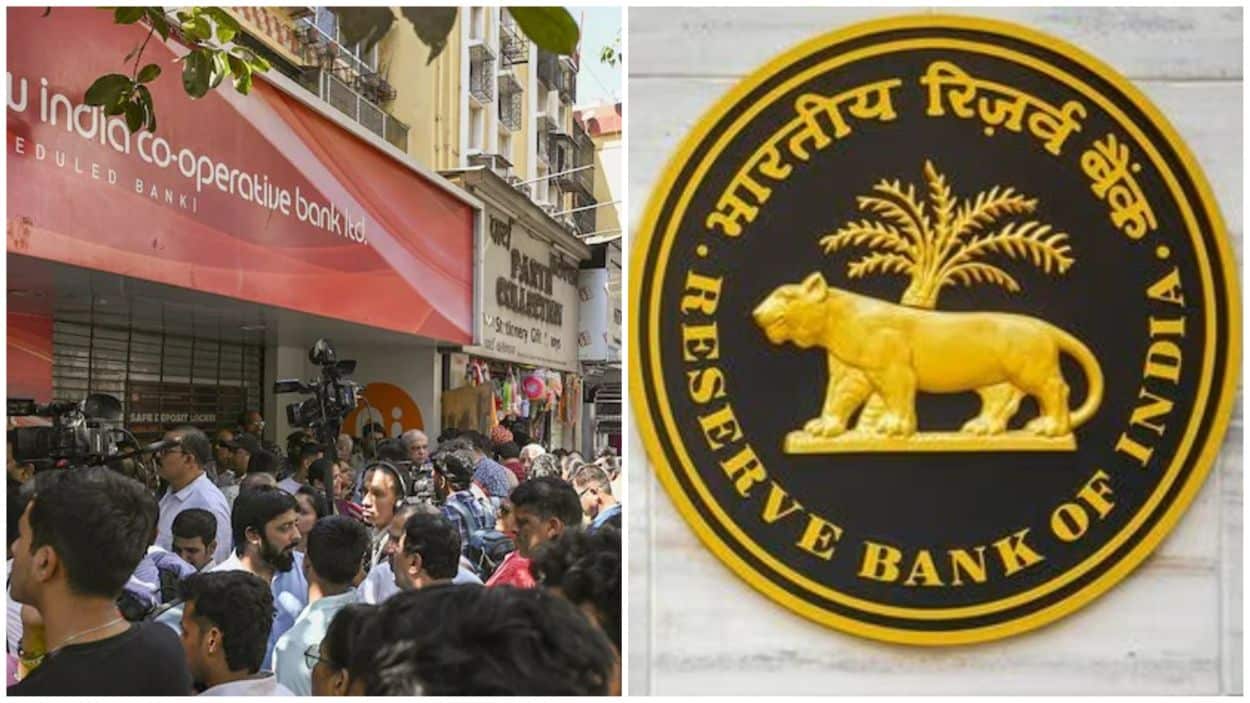

#WATCH | Mumbai, Maharashtra: People gather outside the New India Co-operative Bank after the RBI issued a notice to halt all business pic.twitter.com/kkzXmCIMqe

— ANI (@ANI) February 14, 2025Reasons Behind RBI’s Decision:

The RBI’s decision came after a thorough evaluation revealed that New India Co-operative Bank’s financial stability was in jeopardy. The bank’s primary concern was solvency, prompting immediate restrictions to prevent further deterioration and protect depositors.

The enforcement of these restrictions has caused significant distress among the bank’s clientele. Upon hearing the news, many depositors rushed to their branches in hopes of withdrawing their savings, only to find themselves unable to access their funds. The RBI assures that the Deposit Insurance Scheme protects deposits up to Rs 5 lakh, providing some relief against potential losses.

Chaos erupted outside the New India Co-operative Bank, in #Mumbai, after the Reserve Bank of India (#RBI) imposed restrictions on the bank, effectively halting its business operations from February 13, 2025.

Know more 🔗 https://t.co/7gQ5b1pYUK#ReserveBankOfIndia… pic.twitter.com/wotFKpGz60

— The Times Of India (@timesofindia) February 14, 2025The situation has sparked widespread reaction on social media, with numerous posts depicting long queues and locked bank doors as customers grapple with restricted access to their funds.