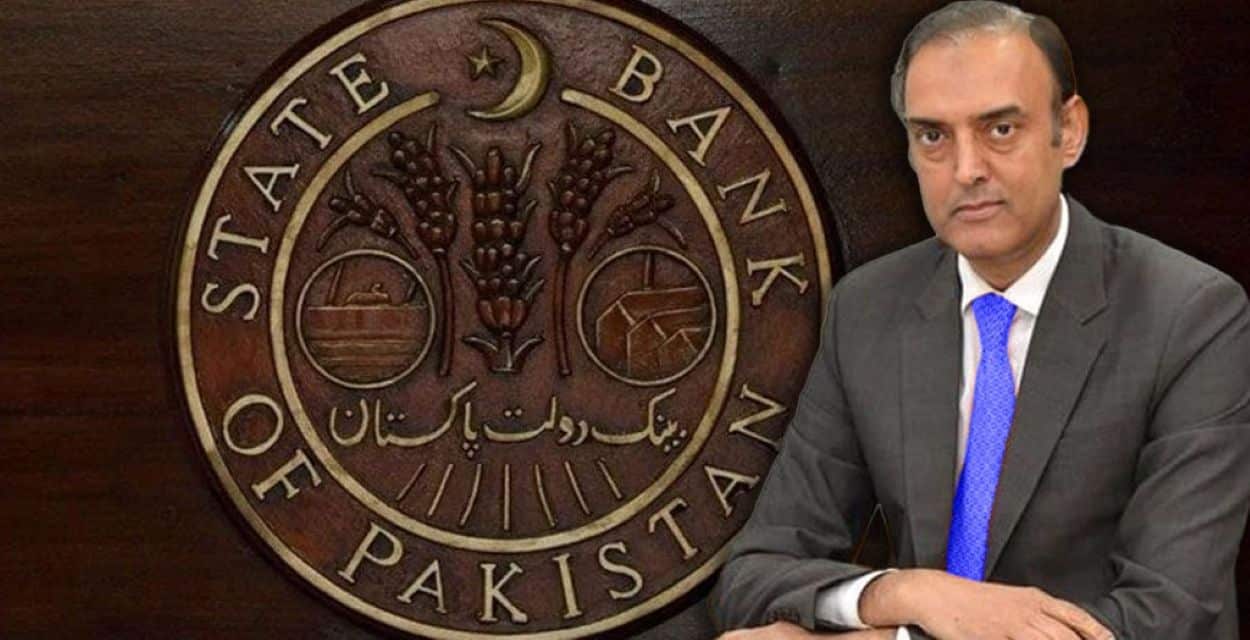

On July 9, 2025, State Bank of Pakistan (SBP) Governor Jameel Ahmad announced plans for a central bank digital currency (CBDC) pilot and the finalisation of the Virtual Assets Act 2025 to regulate cryptocurrencies, aligning with global blockchain trends.

Speaking at the Reuters NEXT Asia summit in Singapore, Ahmad revealed the SBP’s work on a CBDC pilot, building capacity with tech partners to modernise Pakistan’s financial system, per Reuters. The Virtual Assets Act 2025, approved on July 9, establishes an independent regulator to license crypto firms, per the Pakistan Crypto Council (PCC). The SBP’s May 2025 clarification deemed virtual assets legal but restricted banks until regulations are finalised.

Pakistan Crypto Council’s Role

The Pakistan Cryptocurrency Council (PCC), led by CEO Bilal bin Saqib, has appointed Changpeng Zhao, founder of Binance, as a strategic advisor. The PCC is planning to establish a state-run Strategic Bitcoin Reserve and is exploring the use of surplus energy for bitcoin mining. To support these initiatives, the council has engaged with U.S. firms such as World Liberty Financial, which is connected to former President Donald Trump.

The PCC’s goal is to boost Pakistan’s $350 billion economy, with projections indicating that cryptocurrency transactions could reach $20 billion by 2024. However, critics, including economist Kaiser Bengali, caution against the risks associated with volatility in these ventures.

Pakistan’s foreign reserves have increased to $14.5 billion, up from $3 billion in 2023. Additionally, inflation has dropped to 3.2% in June 2025, down from 38% in May 2023. These improvements support the push for a central bank digital currency (CBDC). The benchmark interest rate has been reduced to 11%, down from 22%, in alignment with maintaining inflation within a target range of 5–7%.

The $7 billion IMF program, in effect through 2027, drives reforms and reduces reliance on future bailouts. Ahmad dismissed concerns over dollar-denominated debt exposure, noting that only 13% of the debt is in Eurobonds.