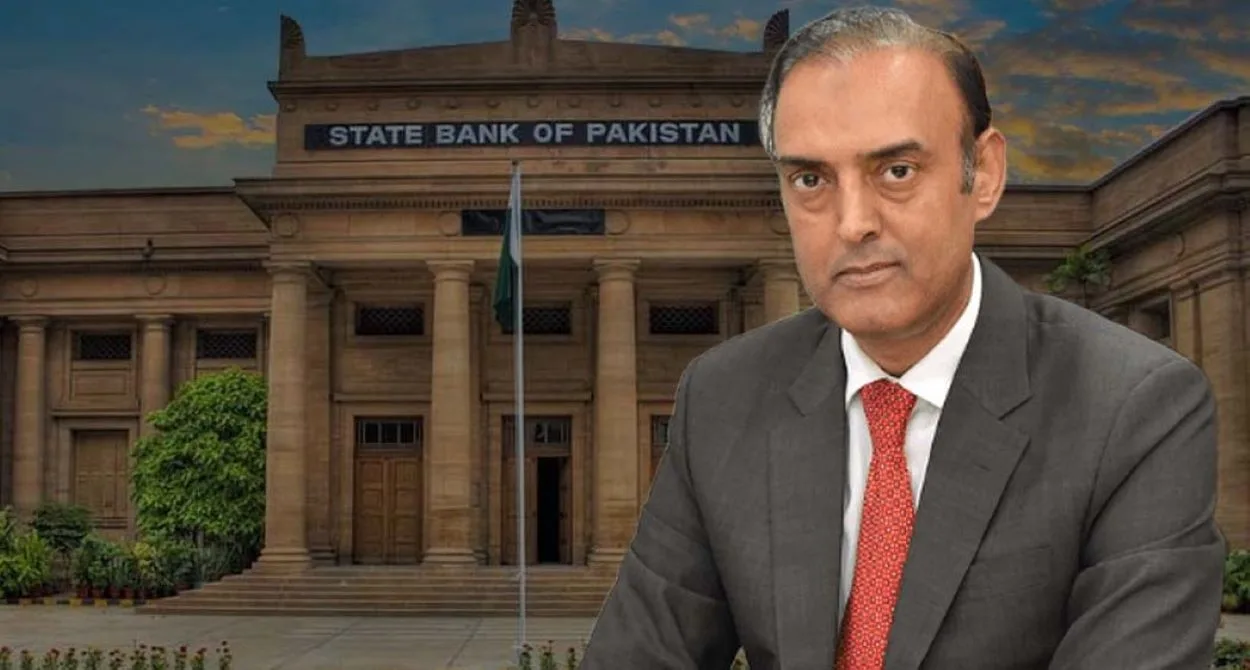

State Bank of Pakistan (SBP) Governor Jameel Ahmad, alongside the Security and Exchange Commission of Pakistan (SECP), revealed plans to eliminate interest (Riba) from Pakistan’s economy by 2027.

On Monday, SBP’s Governor Jameel Ahmad made these remarks during his address at the Islamic Capital Markets conference in Islamabad. The initiative is part of a broader scheme to advance the Islamic finance sector within the country.

In the previous decade, Islamic banking in Pakistan has grown significantly by 24%. It now constitutes 20% of the country’s banking sector, demonstrating its ongoing evolution. According to Ahmad, the Islamic capital market in Pakistan has grown to around $3 trillion, positively impacting the country’s economy.

To further this development, Pakistan has issued Sukuk bonds, a type of Shariah-compliant bond worth Rs2.8 trillion.

In the SBP, a dedicated committee is now working on transforming government debt into Sukuk. Ahmad further disclosed that discussions are underway to fulfil funding needs through Shariah-compliant capital market sources.

Read: Govt forms steering committee for Riba-free banking in Pakistan

Addressing the conference, SECP Chairperson Akif Mian highlighted the significant measures taken in response to last year’s Federal Shariat Court’s (FSC) ruling.

The court instructed Pakistan to implement a riba-free banking system and transform the economy into an Islamic financial system by the end of 2027. This transformation aims to promote the capital market further.

The FSC’s ruling in April 2022 asserted the absolute prohibition of Riba (interest) as per Islamic injunctions, the Holy Quran, and the Sunnah. Furthermore, the judgment directed the complete elimination of Riba from Pakistan by the end of 2027, a decision endorsed by the incumbent federal government led by the Pakistan Muslim League-Nawaz (PML-N).

The decision is significant, considering the case had been pending before the court for almost 20 years. As per reports, various banks were planning to appeal against the FSC judgment. However, the current federal government has supported the ruling, signalling a significant shift towards an Islamic financial system in Pakistan.