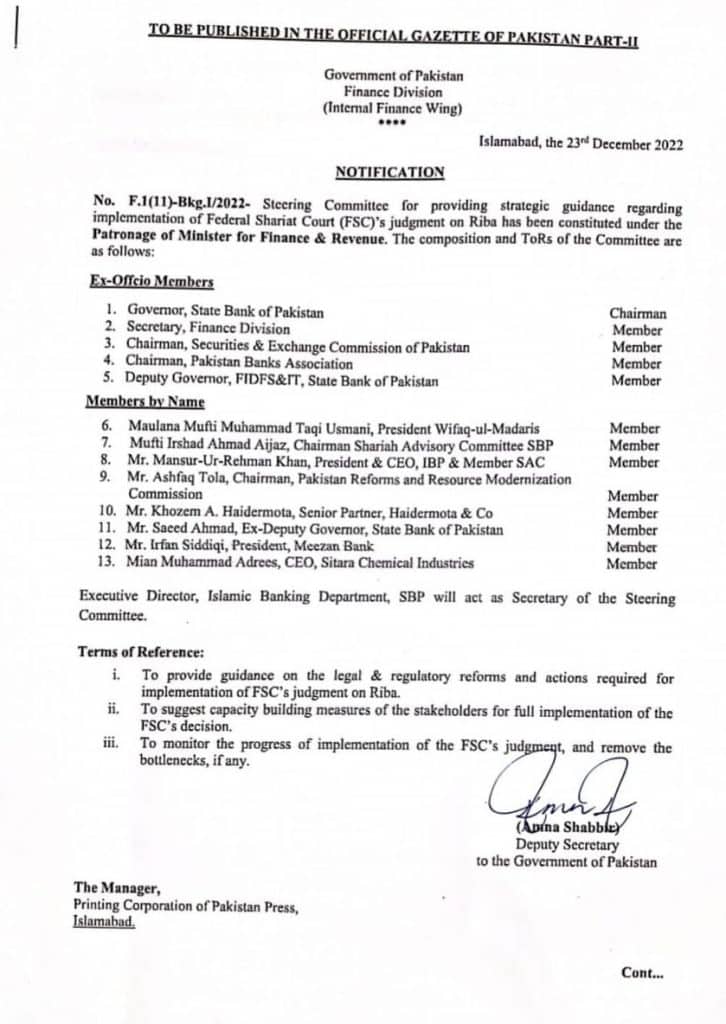

The government formed a 14-member steering committee of religious academics, bankers, chartered accountants, and entrepreneurs to eliminate Riba within five years, given the Federal Shariat Court (FSC) deadline.

According to a finance ministry notification, the group will comprise eight private sector members and five ex-officio government members.

The steering committee members include

Ex-Office Members

- The SBP governor

- Deputy governor of FIDFS & IT SB

- Finance division secretary

- SEC Chairman PBA Chairman

Member By Name

- Maulana Mufti Muhammad Taqi Usmani, President of Wifaqul Madaris

- Mufti Irshad Ahmad Aijaz, Chairman of the Shariah Advisory Committee of the State Bank of Pakistan (SBP)

- Mansurur Rehman Khan, President and CEO of the Institute of Bankers Pakistan

- Ashfaq Tola, Chairman of Pakistan Reforms and Resource Modernisation Commission

- Khozem A. Haidermota, Senior Partner, Haidermota & Co

- Saeed Ahmad, former deputy governor of SBP

- Irfan Siddiqi, President, Meezan Bank

- Mian Muhammad Adrees, CEO of Sitara Chemical Industries.

The steering committee would provide strategic direction on legislative and regulatory reforms and activities needed to implement FSC’s Riba ruling. It would also advise capacity-building initiatives for parties to execute the FSC’s decision, monitor progress fully, and remove bottlenecks.

Finance Minister Dar said in November that the SBP and the National Bank of Pakistan would immediately withdraw appeals against the FSC order to eliminate Riba (interest) by changing banking in the country by Dec. 31, 2027.

The FSC’s April 28 judgment also instructed the federal and provincial governments to finish the relevant legislation, put all laws into accordance with Islamic injunctions by 2027 and implement Shariah-compliant borrowing modes in the future.

SBP, NBP, and three large private commercial banks — MCB, United Bank Limited, and Allied Bank Limited – appealed the FSC ruling in the supreme court. SBP and NBP later abandoned their petitions.

Minister of State for Finance Aisha Ghaus Pasha told a parliamentary panel that everything would not be converted to a 100pc Islamic system within five years because the country and its financial system are internationally integrated. However, there is a lot of appetite for the Islamic system among the majority population as some multilateral institutions use such products.